- About

- Areas

- MarTech

- Sales & Services

- FinTech

- Capital Markets

- Banking

- Business Analytics

- HR Digital Transformation

- Innovation & Entrepreneurship

Analytics & Digital Business

Human Resources Managment

Entrepreneurship

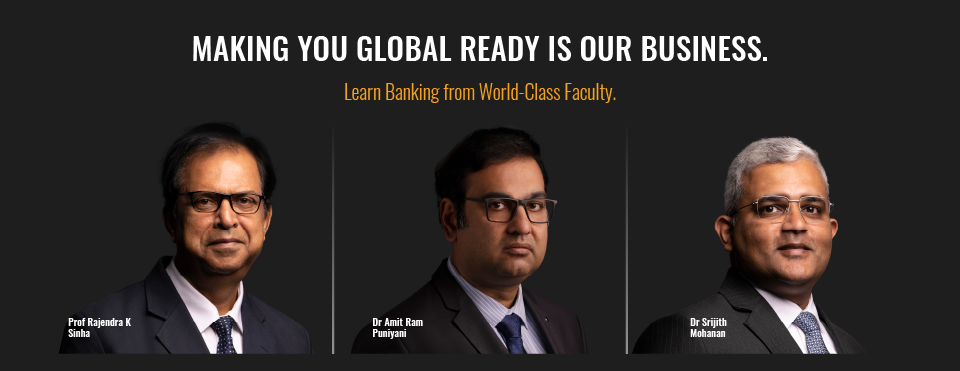

- Faculty

- MarTech

- Sales & Services

- FinTech

- Capital Markets

- Banking

- Business Analytics

- HR Digital Transformation

- Innovation & Entrepreneurship

- Innovation & Entrepreneurship

Analytics & Digital Business

Human Resources Managment

Entrepreneurship

- Students

- Martech

- Sales & Services

- FinTech

- Capital Markets

- Banking

- Business Analytics

- HR – Digital Transformation

- Innovation & Entrepreneurship

Analytics & Digital Business

Human Resources Managment

Entrepreneurship

- Alumni

- Contact Us