The AIM-Parasuraman Centre for Service Excellence, at The Jagdish Sheth School of Management, unveiled the Index of Service Excellence in India (iSEI) 2023 Report on December 20, 2023, at an event attended by industry leaders and marketing scholars of global repute from schools like Yale, Texas A&M & INSEAD.

- About

- Areas

- MarTech

- Sales & Services

- FinTech

- Capital Markets

- Banking

- Business Analytics

- HR Digital Transformation

- Innovation & Entrepreneurship

Analytics & Digital Business

Human Resources Managment

Entrepreneurship

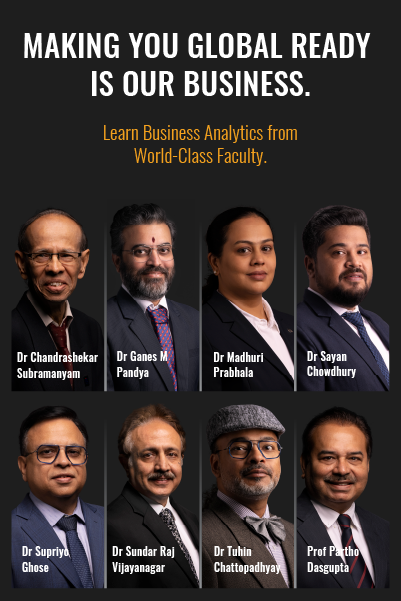

- Faculty

- MarTech

- Sales & Services

- FinTech

- Capital Markets

- Banking

- Business Analytics

- HR Digital Transformation

- Innovation & Entrepreneurship

- Innovation & Entrepreneurship

Analytics & Digital Business

Human Resources Managment

Entrepreneurship

- Students

- Martech

- Sales & Services

- FinTech

- Capital Markets

- Banking

- Business Analytics

- HR – Digital Transformation

- Innovation & Entrepreneurship

Analytics & Digital Business

Human Resources Managment

Entrepreneurship

- Alumni

- Contact Us